2023 was a significant surprise. I think we always look at our most recent pain with the expectation that is how our next pain will appear, aka a massive cliff with prices plummeting. I think that when rates popped up above 5%, many people expected to see a correction. Obviously, that’s not what happened.

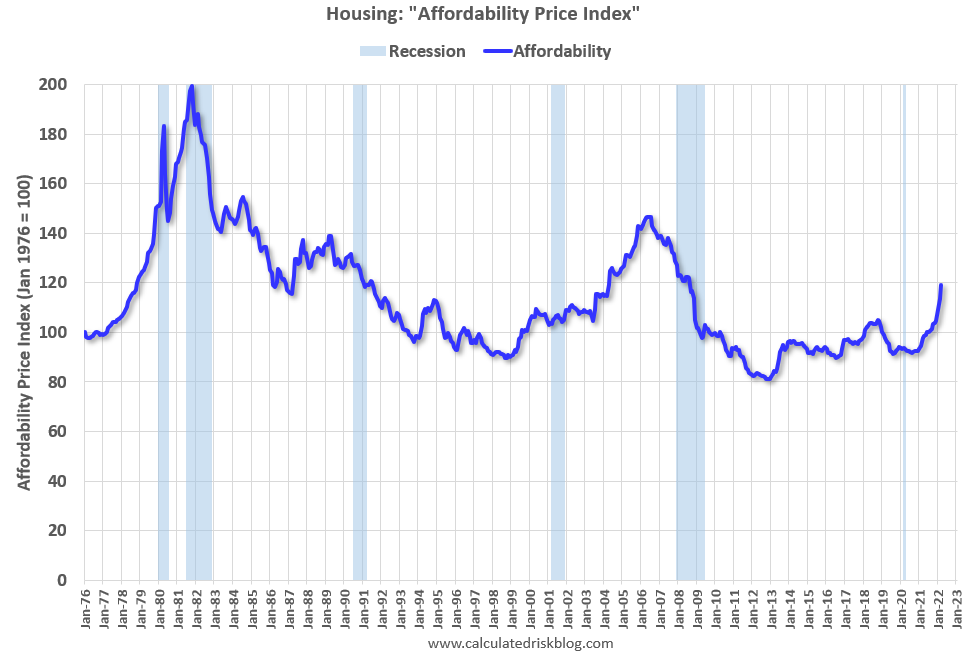

Instead, what we saw was a decreased volume of active inventory aka a constrained supply that more or less correlated with reduced demand. As a result, we didn’t experience lower prices. Instead, both prices and rates went up. This combination resulted in one of the lowest affordability rates historically.

Just like the correlation between low supply and low demand, which propped up pricing, we had a higher correlation of cash for many transactions. Buyers paying cash were certainly less concerned with rates and the affordability without a loan.

What can we expect for 2024?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link